Employee Benefits Market Check Survey: Taxability of Certain Employee Premiums

Many employers provide disability coverage and voluntary indemnity benefits (accident, hospital, cancer) to their workforce. While the benefits are important, they do not carry the same tax-advantaged treatment as health coverage. The benefits payable may be taxed to the employee depending on how the premium is paid.

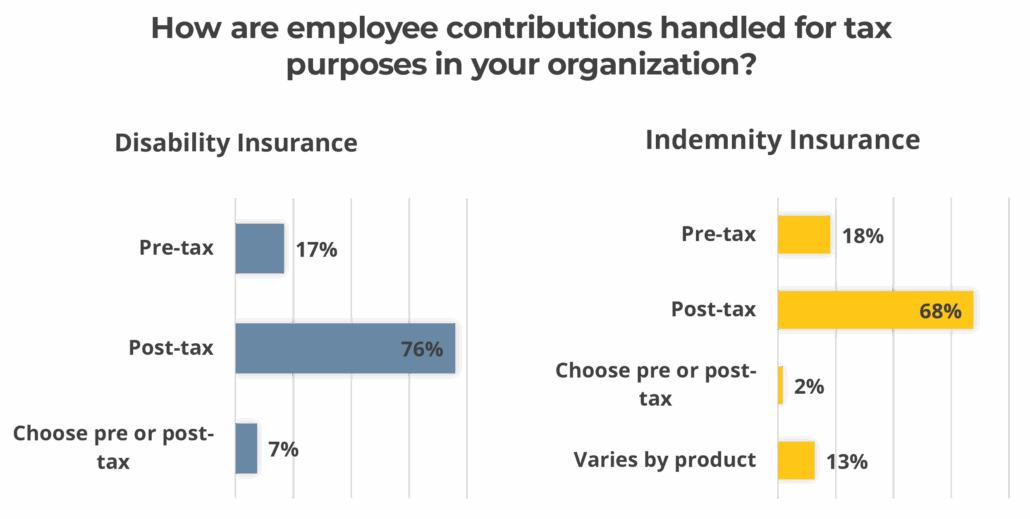

On April 17, we conducted a survey to determine whether employers allow their employees to contribute for certain coverages on a pre-tax or post-tax basis. The results are in the charts below.

*Results based on 127 employer respondents.

Advantages of pre-tax contributions are immediate tax savings and higher take-home pay while the disadvantage is a future tax liability.

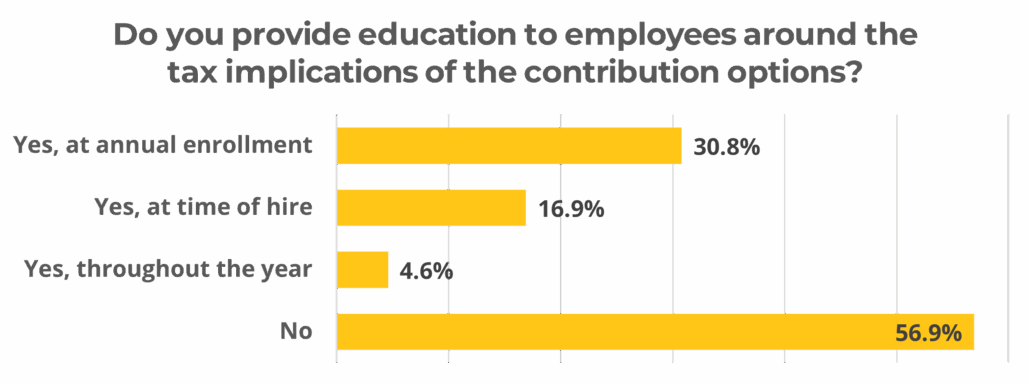

*Results based on 130 employer respondents. Allowed to select multiple answers.

Key Findings

While employers may offer the option to contribute to these coverages on a pre-tax basis—either partially or in full—doing so is generally not recommended. Any benefits received would then be subject to taxation, significantly reducing the amount employees receive when they need it most.

For disability insurance, paying premiums on a post-tax basis reduces an employee’s tax burden during a time when finances may already be strained. It also increases the effective percentage of income replaced during a disability. Similarly, for voluntary fixed indemnity plans, post-tax contributions eliminate the requirement for employees to substantiate actual medical expenses incurred.

As a result, most employers encourage or require employees to make post-tax contributions for these types of coverage.

Whether you allow pre-tax or post-tax contributions, providing clear education on the reasoning behind these structures helps employees better understand and appreciate the value of their benefits. Currently, just over half of employers don’t offer any education on this topic throughout the employee life cycle, highlighting a valuable opportunity to foster more informed and confident benefit decisions.

Should you have any questions regarding any of this information or want to discuss your premium options, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!