Assurex Global Market Check Survey: Additional Flexibility for FSA and DCAP

Due to the continued impact of COVID-19, Congress has recently provided employers with some additional flexibility in administering Health Flexible Spending Accounts (FSAs) and Dependent Care Assistance Plans (DCAPs). Many employers are contemplating whether to make some or all the permitted changes (none of them are mandatory).

A quick summary of the temporary changes allowed:

- Grace periods – for plan years ending in 2020 or 2021, employers can implement a grace period of 12 months to submit claims

- Carryovers – for plan years ending in 2020 or 2021, employers can allow participants to rollover entire, unused balances to the following year

- Election changes – for plan years ending in 2021, employers can allow employees to make prospective changes to their election in either the FSA or DCAP

- Extending dependents – employers can allow the plan to reimburse expenses for a dependent who has not reached age 14 (standard is age 13), assuming certain criteria is met (For DCAP only)

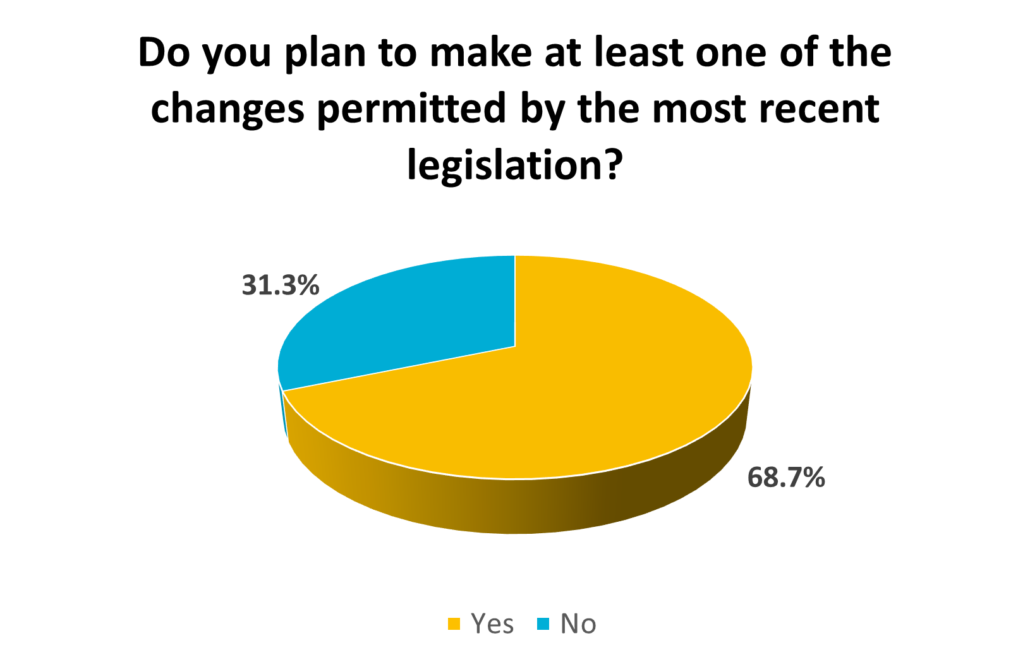

We conducted a poll during a webcast covering this topic on January 21 to see what employers are planning and the results are in the chart below.

Based on 115 employer respondents; January 21, 2021

Employers who decide to make any of these changes will need to notify plan participants and amend their plan documents. While employers are not mandated to make any of these modifications, companies would be well served to consider all of them. Implementing these would give employees additional peace of mind and financial flexibility, at a time when stress and anxiety are at elevated levels. Should you need any assistance with understanding the impact of these temporary changes, please contact your local Assurex Global adviser.

Leave a Reply

Want to join the discussion?Feel free to contribute!